The “tipping point” refers to that moment when a small change tips the balance of a system and brings about a large transformative change. It became part of common business lingo with the publication of Malcom Gladwell’s “The Tipping Point: How Little Things Can Make a Big Difference” in 2006. In 2020, it has been seen in epidemiology with a spread of influenza that suddenly turned into an pandemic, but more often we see tipping points in behavior or technology that cross an invisible threshold, tip, and then spread like wildfire (another unpleasant feature of 2020 in the Western U.S.)

It’s a phenomenon that has also been paraphrased as “slowly, slowly then quickly.” In 2020, we have tipping points operating like dominos as the pandemic forces social changes that bring related buying and business management changes. In many cases, the pandemic has dramatically accelerated changes that were already underway such as e-commerce adoption and working from home. Changes that may have taken place over the next several years or even decades have been compressed into mere months.

Marco Boer of I.T. Strategies, presented “Opportunities Enabled Post-COVID by Production Inkjet Printing” as the keynote of the Printing United Commercial Digital Inkjet Day where he suggested that the pandemic has accelerated the shift of offset volumes to digital by at least 2 years, and that digital inkjet will be the beneficiary of that shift.

Boer paints a picture of North American offset volumes that is dire with a 40 percent drop in 2020 and no expectation of a complete return to previous levels. While offset levels are expected to rebound somewhat this year and next, they quickly plateau in 2022 and begin to decline again in 2023 and beyond.

Volume is not the only slowly-slowly-quickly story here. Labor shortages were also approaching a tipping point prior to the pandemic. Boer had previously reported labor statistics showing that starting in 2026, the US would have 500,000 fewer workers entering the workforce annually due to a drop in birth rates. Coupled with the fact that the average age of skilled offset professionals is over 55, a trend toward efficiency and automation was already underway at forward-thinking commercial print operations. But, once again, Boer tells us, “this tipping point starting early because COVID is making it hard to have workers in the plant.” To make matters worse, older workers may choose early retirement rather than exposing themselves to infection and other workers with children may not be able to return to work due to school closures. These multi-layered labor challenges are not a gentle tip for offset shops, but rather a two-handed shove towards automation.

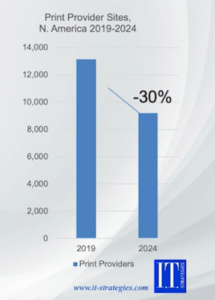

There is no question that traditional press OEMs have made great strides with automation in recent years, but in many cases, offset automation will not be enough to compensate for reduced volumes and an accelerated shift to shorter runs. Again, volume is not the only story here. Print buyers have also suffered losses this year. Their print budgets will not go up and are more likely to decline. Boer advises that buyers are cautious and will be buying in smaller lots and thinking hard about why they need print. They will demand higher value and return from print investments and will not tolerate waste. At the same time, paper prices are expected to ratchet up putting further downward pressure on volumes. The net of all of this shifting, tipping and shoving is that we may have 30 percent fewer print providers in North America by the end of 2024 according to I.T. Strategies’ projections.

The Imperative for Automation and Demand for Value

The offset players who survive the purge will continue to compete in a large but declining market. Continuous and cut sheet inkjet are the only platforms positioned to cost-effectively meet new customer demands for quality and results at any run length. However, digital players can’t get complacent either. Going forward, digital workflows will need to be exceptionally well tuned to handle increasing volumes of decreasing job sizes. Boer recommends that print providers get more involved in strategy and content development with customers in order to drive and measure results. Print providers need to take part in response rate measurement in order to sell to value. None of this is simple or easy warns Boer, and it takes time to build credibility, but it is the new reality of our market.

Inkjet is the only print technology platform showing significant growth over the next 4 years. Color toner pages are also growing – but those are a smaller percentage of total toner volumes and a shrinking percentage of digital overall.

Boer positions our post-COVID world, not as a new normal, but as a rebirth of the print industry with a focus on streamlined automation all the way through finishing, shipping and logistics in order to minimize labor pressures and meet customer demands for faster turn times. There will be a requirement to “obsessively” track everything in order to continuously improve and to demonstrate value to customers. According to Boer, those who survive the tipping point will be in better shape in 2024 than ever before if they make the necessary changes.