In June we reported on the growth of the Kodak inkjet portfolio with the introduction of the Kodak Prosper 7000 Turbo and the market launch of the Kodak Prosper Ultra 520 based on Kodak STREAM and ULTRASTREAM respectively. This month we reported the announcement of a reseller agreement between Kodak and Graphco to accelerate the promotion and implementation of Kodak’s portfolio.

The companies share some interesting parallels. They both serve the commercial print and packaging markets; they both cater to offset, toner and inkjet press customers; and, they are both headquartered in the US. In fact, Graphco headquarters is located only a three hour drive from the Kodak inkjet manufacturing facility in Dayton Ohio. Despite all of these commonalities, 2022 marks the first time these companies have teamed up.

I had the opportunity to speak with Chris Manley President of Graphco (and son of Graphco founder, Bill Manley) and Jeff Zellmer, VP, Global Sales and Strategy for Kodak about the partnership, target markets for inkjet, and the ability to drive sales despite supply chain challenges.

Chris Manley, Graphco |

Jeff Zellmer, Kodak |

Why this partnership? Why now?

As is often the case, the development of this agreement was many months in the making. In addition to the convenient location of Kodak’s primary demonstration center just a few hours from Graphco headquarters, and the strong overlap in target markets and customer approach, Kodak had an internal advocate at Graphco. Gary Greis, Graphco Regional Manager was previously VP of Operations with The Hennegan Company, (an RR Donnelley Company). During his tenure at Hennegan, Greis purchased three Kodak Nexpress machines and numerous CTP and workflow solutions from Kodak. According to Manley, “Gary was extremely supportive of partnering with Kodak based on the consistently high quality level that his operation was able to offer some of the United States’ most selective customers using Kodak solutions.”

Kodak has brought numerous new products to market without a proportional increase in their staff. This relationship amplifies Kodak’s sales and service capabilities by allowing Graphco to offer the entire lineup of Kodak digital press solutions, as well as the Sonora process free plates, Trendsetter, Achieve and Magnus CTP solutions and Printergy digital workflow products. While the opportunities for both Kodak and Graphco are significant, bringing these products to market, and driving installations, in a way that is seamless to customers requires considerable strategic planning.

“Initially, Kodak will provide installation and technical services for our inkjet products. Graphco has a world class team of service experts on staff that will begin training on many of the products in Kodak’s portfolio,” says Kodak’s Zellmer. “Kodak currently provides products and services to over half of the largest US commercial print providers. Graphco’s long history of leadership and outstanding client relationships will only add to that reach and our plan is to selectively increase our client base as a team. “

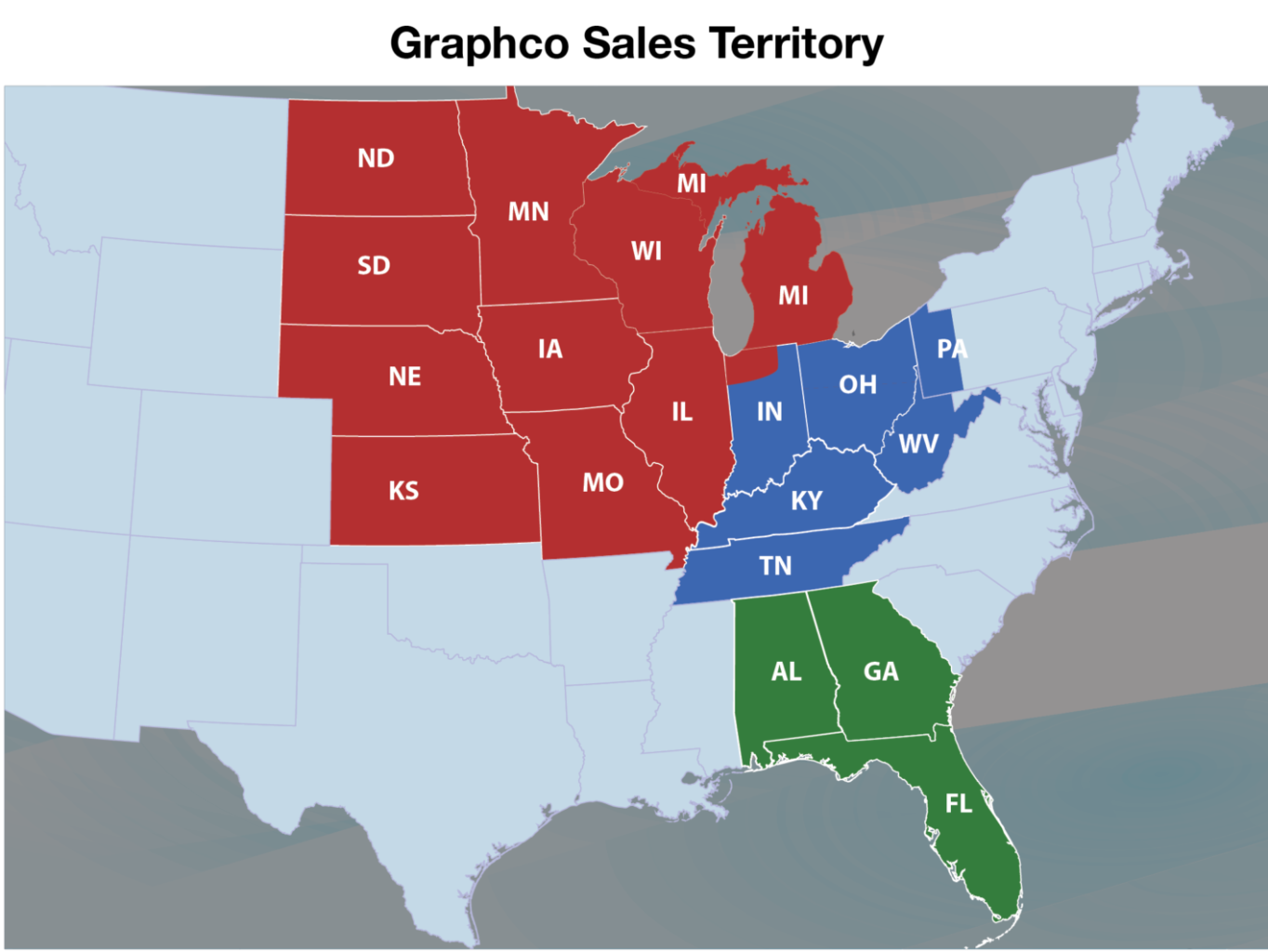

Naturally, with any reseller agreement, avoiding channel conflict is important to managing a strong partnership. “Graphco will be focused on the states and areas in which they currently have sales presence including both existing and potential new clients,” says Zellmer. Manley adds, “Graphco’s sales team has been largely focused on our Midwest and Southeastern territories, so we have three Regional Sales Managers covering that area. We are actively working with several industry professionals throughout the rest of the US to build a top-notch sales team focused on Kodak and announcements of those hires will be forthcoming.” Of course, regional assignments can oversimplify relationships, particularly when customers can have facilities in multiple states. “Kodak works collaboratively with our dealer partners to determine how we will work together with each potential client,” assures Zellmer. In many instances, Kodak and Graphco sales teams will work together on accounts. Manley notes that, “Both organizations put a very heavy emphasis on our customer’s needs and this philosophy will be paramount in all of our engagements. The customer comes first at both Kodak and Graphco, so this alignment was quite easy from the onset of our relationship. “

Primary market focus

Initially, Kodak will want to take advantage of Graphco’s lengthy history in the commercial print space. However, Zellmer points out that, “Many printers in the traditional commercial space are exploring new revenue opportunities and markets with items such as light packaging, point of purchase display, and other items. In addition to our inkjet portfolio, Kodak recently introduced a new toner based press called the Ascend which Graphco feels will have appeal to many of their clients.” Manley elaborates, “Recently we have made several highly successful sales into the folding carton segment, including a 100 percent start-up of a folding carton plant that has already shipped 50 million folding cartons. So, that segment seems ripe for the level of automation, quality and durability the Kodak product offers. “

Kodak sees inkjet as a complementary offering to Graphco’s offset installed base. Many of Graphco’s current clients already have inkjet devices, or are exploring them as products that can generate revenues and flexibility for their operations. “In today’s uncertain supply chain climate, forward looking printers are looking at alternatives to the traditional offset process that is heavily reliant on many scarce supplies such as aluminum,” says Zellmer. “Graphco’s long standing relationships in the commercial print industry will also allow them to expand their client base with the exciting new products we have introduced.”

Manley also sees digital presses as complementary to their success with offset sales. “During the past eight years over 100 new RMGT 9 Series offset presses have been installed throughout North America, and many of these presses have gone into commercial environments that produce direct mail and other promotional print of all kinds,” says Manley. “With the incredible speed, ultra-high quality and affordable cost of Kodak Prosper and Nexfinity products we feel we can have a similar impact on the variable data, versioning and transactional side of our customer’s businesses.”

Expanding inkjet experience

Graphco has many years of experience selling digital press equipment and related finishing, including Konica Minolta B2 sheet fed inkjet equipment. However, the Kodak relationship will be their first, and exclusive, partner for continuous inkjet. Manley states, “While other inkjet products have come up on our radar, Graphco’s reputation for providing only top of the range solutions made the Kodak Prosper line-up the only solution we felt 100 percent comfortable offering to our customers.” Manley continues, “The bar for inkjet production level, print quality and robustness of design has moved up dramatically with the release of the Kodak Prosper 7000 Turbo. For Graphco to enter this highly competitive ecosystem at the absolute top of the food chain by offering the 7000 Turbo’s 24.45” wide output running at 1,345 FPM while producing 100 LPI print quality makes us proud to bring the current industry standard to our customers.”

The Graphco sales team, who have not previously represented aqueous inkjet equipment, will receive extensive product and application training as part of the relationship. Zellmer notes that the ability to provide training and support to all Kodak partners is of paramount importance. “Kodak has developed a worldwide infrastructure to support our global reseller partner channel,” says Zellmer. “We have a team that is focused on providing world class training, marketing and sales support to hundreds of reseller partners all over the world. We are committed to continued development and growth in this critical area, and are implementing several new operational systems to enhance our training, administrative and marketing support functions for our reseller partners.”

Delivering the goods

Zellmer’s references to an uncertain supply chain climate are affecting many digital press providers as well. Several inkjet OEMs have indicated that they have sold out of inventory for the remainder of 2022. Current challenges and delays with shipping components internationally provide an advantage for companies that are manufacturing products in the same region or country where they will be sold well into 2023.

Kodak uses a domestic, build-to-order process for its PROSPER Presses and PROSPER Imprinting Systems. Zellmer indicates that current equipment lead times are, “Typically three to five months for presses and two to three months for imprinting equipment.”

Graphco indicated that it was appealing to them to work with a manufacturer who was located right in their home state of Ohio and the fact that a majority of the Kodak products they will sell are manufactured in the USA was a positive for them and their clients.

“The great thing about this new engagement is that both organizations will fully support the other organization toward the mutual benefit of our customers,” says Manley. “ Jeff Zellmer’s Team are extremely professional, so we are very excited to work together in growing Kodak’s strength in the inkjet market.”