Digital equipment vendors and industry pundits have been looking at the packaging market as the next major opportunity for digital technology for some time now. After the eclipse of screen-printing in display graphics and ceramic tile printing, and the replacement by transactional printers of mono toner machines by 4-color inkjet ones, the industry needs a new juicy target. The attraction of packaging is not hard to understand – package printing has high barriers to entry, is not subject to internet substitution and grows faster than GDP. At over $300 billion worldwide, it is huge. This is reflected in the fact that packaging converters currently sell for higher multiples of earnings than commercial printers – roughly 9x EBITDA[1] versus 6x, according to M&A[2] specialist New Direction Partners, LLC.

I count myself among these commentators, having first researched packaging opportunities for a printhead vendor in 2006. My conclusion back then was that there was a long way to go to meet even the most modest needs of the packaging supply chain. And my conclusion to a 2015 SGIA talk I gave on the packaging opportunity was that digital printing and finishing represented less of a tsunami than a slow rise in sea level. This still holds true – the package printing climate is changing, and waves of new technology are breaking on the shores of short-run work, but the packaging mainland is mostly unaffected so far.

Over the next few weeks, we’ll explore the digital opportunities – and the hurdles to overcome – in the packaging market. But first, let’s sketch out a picture of the market. Most analysts divide the market into four main segments:

- Labels – a mix of pressure-sensitive and adhesive-applied materials, mostly printed roll-to-roll on narrow-web flexographic or offset presses with inline rotary die-cutting

- Folding cartons – primary packaging made from carton-board, mainly color printed on sheetfed offset presses and then flatbed die-cut.

- Flexible packaging – primary packaging made mainly from laminated plastic films and foils, 82% of which are flexo-printed on large ‘CI’ (central impression cylinder) presses.

- Corrugated – mainly secondary packaging made from printed paper ‘liner’ sandwiching a fluted material. 85% of corrugated is printed as 1-3 spot colors rather than process CMYK, using flexo or offset presses.

This segmentation ignores glass, plastic and metal container printing, often characterized these days as ‘direct-to-shape’, although in-mold labelling and shrink sleeves account for much of it. We’ll talk a little more about the digital opportunity for container printing in a later article.

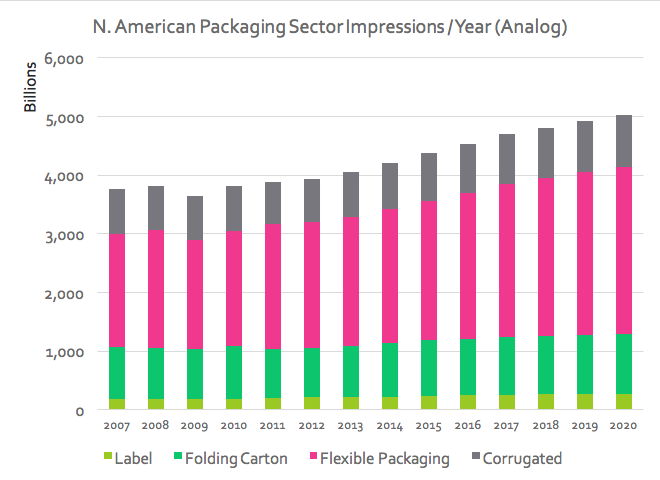

Below is a 2016 I.T. Strategies’ view[1] of the relative sizes and growth rates of conventional (analog) printing in North America in these four main packaging segments from 2007 – 2020:

The y-axis represents billions of impressions per year and illustrates the predominance of the flexible packaging segment in terms of both relative size and growth rate. The CAGR (compound annual growth rate) of analog printing over the 2015-2020 period is 2.8%, whereas flexibles are growing at 3.2%, and labels at 3.7%. The laggards are corrugated and folding cartons, each with 1.4% CAGR.

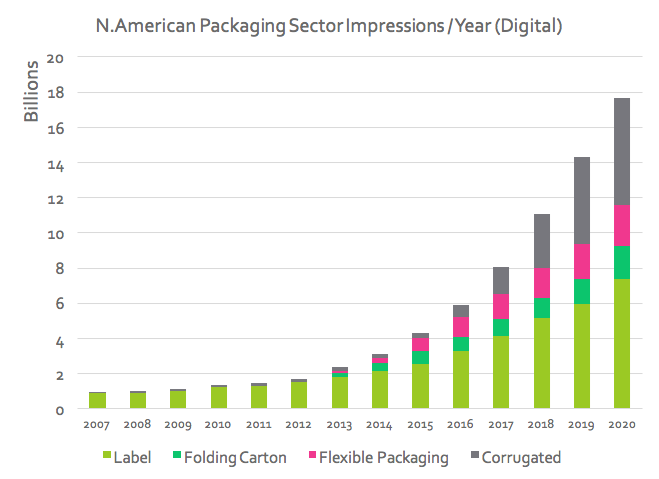

Now compare the I.T. Strategies’ view of the relative sizes and growth rates of digital (toner and inkjet) printing over the same period:

Several things immediately stand out: the first that strikes the eye is that digital growth rates look spectacularly exponential – an overall 2015-2020 CAGR of 32.6%, with corrugated coming in at an astonishing 86%. The label sector, which represented virtually the only digital application until about 2012, is forecast to grow by a healthy 23.5% to 2020 as toner-based and inkjet solutions battle for dominance of the label printer market.

But, then our excitement is dampened by a glance at the y-axis: the total number of digital impressions forecast by 2020 is a shade under 18 billion – compared with the total analog impressions of 5,000 billion. In other words, despite the anticipated growth rates, digital printing of packages will still account for less than one third of one percent of all packaging print by 2020.

This looks like what a former colleague used to call “an insurmountable opportunity”. In our next article, we’ll review why this is so – the motivations for going digital in general, and the hurdles to be overcome in each of the segments.

Chris Lynn of Hillam Technology Partners provides product strategy & business development consulting for technology companies with a focus on digital print and packaging.

1. Earnings Before Interest, Tax, Depreciation and Amortization

2. Mergers & Acquisitions

3. I.T. Strategies for Primir Megatrends in Printing 2016