The overall market for packaging is both growing and changing. In the corrugated packaging market there are two key factors driving growth: increasing population of consumers worldwide and the accelerating trend toward online buying. According to the US Census Bureau, the global human population increased by one billion between 1998 and 2010 and by an additional billion from 2010 and 2023. That larger population is buying more of their goods online.

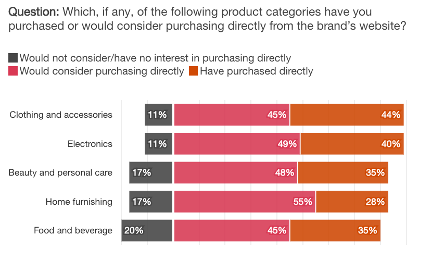

The June PwC Global Consumer Insights Pulse Survey published in June 2023 found that 50% of respondents intended to increase their online spending over the remainder of 2023. This is an acceleration of the 43% reported in their previous (biannual) survey. This uptake in online purchasing includes online shopping with ecommerce giants like Amazon as well as a growing Direct-to-Consumer marketing surge in which more than 80% of consumers polled indicated that they either had purchased or would consider purchasing products across five different segments directly from the producers website (see chart below from PwC’s June 2023 Global Consumer Insights Pulse Survey)

The catalysts for change in market needs for packaging are a bit more diverse but there are several important ones impacting the adoption of inkjet:

- The need for increased product protection as more orders are fulfilled online

- Customers’ demand for packaging sustainability in the form of “fit for purpose” or right-sized packaging using materials that are recyclable and/or use recycled material

- Managing returns using packaging that can be resealed and reused

- As “unboxing” at home challenges retail shelf-awareness as the greatest lever on consumer brand awareness and customer experience, package design and personalization take on even greater importance.

The need for just-in-time, fit-for-purpose and versioned or personalized packaging that is strong and sustainable leads to lower individual run sizes suitable for digital production. While lower run costs typically results in higher unit costs, companies selling direct-to-consumer or through e-commerce sites gain the important benefits of optimizing product inventories, developing a direct relationship with the consumer, and reducing obsolescence of product and packaging particularly in response to changes in regional regulations for materials and labelling.

With all of these factors, it’s not surprising to learn that Smithers report, ‘The Future of Digital Printing to 2032’, indicates that printing on corrugated board is expected to make up a whopping 82% of all incremental growth for inkjet during the 10 year period covered. It’s important to note that not all of this growth may relate to packaging as it is often difficult to separate out corrugated display and signage from packaging volumes.

However, there is no question that OEMs are responding to these market trends with renewed focus on inkjet presses serving the corrugated packaging market, often with flexibility to serve other markets as well. Inkjet production speeds are going up as are breakeven run lengths versus offset while ink costs are coming down (somewhat) and choices are increasing.

Below we’ve provide a preview of the presses that will be covered in our upcoming inkjet shopping guide for corrugated presses (premium content) where we will dig into the details of each press and some of the places where they are currently installed.

Sneak Peek: 2024 Inkjet Shopping Guide for Post-Print Corrugated Presses

|

Manufacturer Press |

Ink/Fluid/Colors |

Speed / Resolution |

Max Board Width |

|

Barberan Jetmaster (multiple configurations) |

UV CMYK plus 2 (Light Cyan & Light Magenta or Orange & Violet) |

80 or 120 m/min 600 dpi |

1380 mm 1610 mm 1840 mm |

|

Domino X630i |

AQ95 Aqueous CMYK No primer |

Up to 75 m/min 600 dpi |

1600 mm |

|

EFI Nozomi C14000 LED |

EFI UV CMYK plus white, orange, violet Primer |

75 m/min 360 dpi |

1400 mm |

|

EFI Nozomi C18000 Plus Nozomi 18000+ LED |

EFI UV CMYK plus combinations of white, orange, violet Primer |

75 m/min 360 dpi |

1800 mm |

|

Flora Rhino 2500 |

Aqueous CMYK |

90 m/min at 450 x 600dpi 60 m/min at 600 x 600dpi 45 m/min at 900 x 600dpi 30 m/min at 1200 x 600dp |

2500 mm |

|

Flora SPC2500 Pro |

Aqueous CMYK |

100 to 150 m/min 1200 x 1200 dpi |

2200 mm |

|

Hanway Glory 1606 |

Aqueous CMYK +2 |

100 m/min 600 x 600 dpi 133 m/min 600 x 450 dpi 150 m/min 600 x 400 dpi |

1606 mm |

|

Hanway Glory 2504 |

Aqueous CMYK |

100 m/min 600 x 600 dpi 133 m/min 600 x 450 dpi 150 m/min 600 x 400 dpi 180 m/min 600 x 300 dpi |

2500 mm |

|

Hanway Elite 2504 |

Aqueous pigment or dye CMYK |

50 m/min 600 x 900 dpi 75 m/min 600 x 600 dpi 100 m/min 600 x 400 dpi |

2500 mm |

|

HP PageWide C550 |

Aqueous CMYK Primer/binder |

90 m/min at 1200 dpi |

1300 mm |

|

Kento Hybrid |

UV CMYK Primer |

Up to 80 m/min 360 dpi |

2100 mm |

|

Konica Minolta PKG-1300 |

Aqueous pigment CMYK |

27 m/min. at 300 x 1,200 dpi 18 m/min. at 600 x 1,200 dpi 9 m/min. at 1,200 x 1,200 dpi |

1300 mm |

|

Koenig & Bauer Durst Delta SPC130 |

Koenig & Bauer Durst Aqueous CMYK + Orange + Violet (Green on request) |

120 m/min 600 90 m/min 1000 dpi |

1300 mm |

|

Koenig & Bauer Durst CorruJET 170 |

Aqueous CMYK Precoater |

120 m/min at 1200 x 600 Max resolution 1200 x 1200 |

1700 mm |

|

Xeikon Idera |

Aqueous CMYK |

Up to 120 m/min on uncoated, 60 m/min on coated up to 1,200 x 600 dpi |

1600 mm |

If corrugated packaging is a market that interests you, and you are not accessing premium content as a member of Inkjet Insight, you will want to register for our March webinar on Innovations in Inkjet for Packaging. Learn more.