The markets that first adopted inkjet, customer communications and direct mail, were quickly transformed through the ability to streamline operations, combine jobs of many sizes and eliminate waste. The effectiveness of inkjet is based on the ability to impact the complete manufacturing process for printed products. According to Dr. Sean Smyth, Group Technical Editor with Whitmar Publications Limited and frequent consultant to Smithers, “If the vendors get the offer right printers will invest. In books they have largely won by offering more efficient book manufacturing rather than just book printing. For example combining workflow to batch titles, printing then finishing automatically to deliver book blocks for binding. Cost comparison of manufactured books rather than printed sections makes economic crossover at higher volumes against litho. When a print product is digitally manufactured it makes pure print cost comparison less of a barrier.”

As economic pressures and a growing desire for personalization drive down the size of individual order sizes across markets, the manufacturing efficiencies of inkjet are further amplified. “The business model of printing is changing,” says Marco Boer I.T. Strategies. “It’s no longer about better economies of scale, it’s about adding value on fewer pieces printed.” Boer notes that this change is very disruptive because it is not easy to change business models.

Labor and supply chain shortages are conspiring to push printing companies towards changing their business models while placing further disruption in their path. Digital and offset print markets are suffering from severe paper shortages as mills convert from production of printing grades to packaging materials. Labor is also in short supply. As the effects of COVID-19 receded and print volumes rebounded, staffing levels did not. Some companies have reported that they are trying to produce 100 percent of the volume with 60 percent of the staff as compared to 2019. This has resulted in high levels of overtime as well as a higher base wages. Boer notes that the big breakthroughs in inkjet technology today are “not on technology – but on the amplification of labor savings on inkjet versus offset. As labor has become difficult to find and expensive, switching from offset to digital has a fast payback.”

Paper Pushes the Margins

Paper producers and distributers are rationing supply across their existing customers. Paper prices are rising, in some cases as frequently as once per quarter. European mills, often considered a safety valve for North American markets, are suffering their own supply shortages and are further hampered by the high costs of shipping to U.S. ports and 30 to 90 day backlogs in getting containers through the ports. In January 2022, the busiest container ports in the U.S.1 had a backlog of 109 ships waiting at sea to unload. In March, the backlog of vessels dropped to 66 in March, but Sea-Intelligence projects that the backlog may increase beyond the January numbers in the second quarter of 2022 with the potential to top 150 vessels. The catalyst for these backlogs is primarily a shortage of warehouse capacity and overland transportation with dock labor also in the mix. The impact to the supply chain is massive with every day at sea adding to the cost and the competition for scarce warehouse and transportation resources driving prices higher.

The current, unpredictable nature of paper supply has forced many companies to work with what they can get, often taking different web widths, finishes or converting their own sheets or web widths to get the work out the door. In an inkjet environment, this may require testing and qualify new papers “on the fly.” It can take several hours to profile each new paper and tune it to the press, adding expense not to mention using up some of the precious paper in the process. Not all companies have staff in house who are qualified to perform this level of color management work, driving further expense for consulting support.

The paper shortage is particularly grim for inkjet formulated papers. As it happens, one of the major areas of investment by inkjet OEMs over the past few years has been expanding substrate compatibility. Smyth notes, “There has been a continuing improvement in quality on standard offset stocks, delivering brighter colors and heavier coverages with reasonable drying.” For those who are not using presses that are compatible with offset papers, there is the option to prime or precoat their own papers off line. Some companies choose this option in order to add flexibility, control costs by only using pre-treatment based on the quality requirements of the particular job.

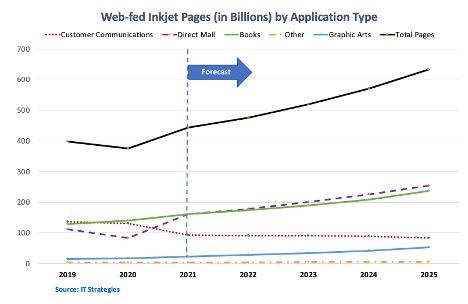

Rolling with the Changes

Despite these constraints, overall inkjet pages continue to grow with 2021 page volumes exceeding pre-pandemic volumes by over 10 percent. “Application growth is greatest in direct mail, book printing, and commercial print,” notes Boer. Printed customer communications, or transaction print, is the only segment in decline. Pages printed on web-fed inkjet presses are projected by I.T. Strategies to reach 570 billion by 2025 with direct mail representing 40 percent of that volume, followed by books with 37 percent. Customer communications, which until recently, was the highest volume producer of production inkjet pages will represent only13% of the volume by 2025, while graphic arts pages are expected to grow to eight percent on the back of advances in color quality and substrate compatibility.

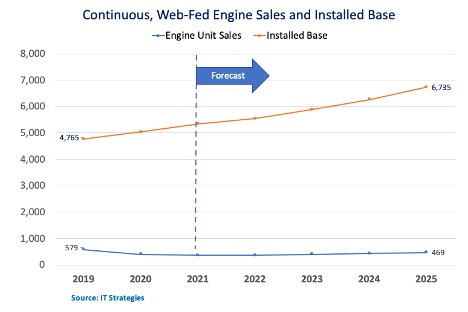

While annual sales of continuous feed inkjet engines are not expected to reach 2019 levels until around 2027, the installed base is growing by more than five percent per year and this does not include upgraded or refurbished presses. I.T. Strategies estimates that up to 100 engines may be sold as refurbished or upgraded units in 2021. HP, for example, has had a strong commitment to providing an upgrade path for their continuous inkjet presses and has been very active in pursuing field upgrades since the PageWide T250HD became available early last year. In many cases, new OEM inkjet releases are not backward compatible which has created a strong aftermarket for refurbished presses.

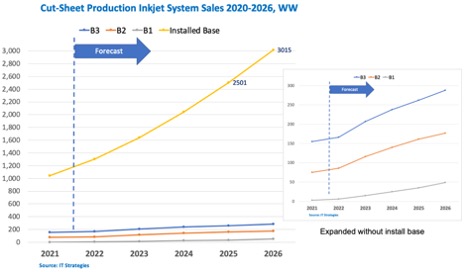

Installations of sheet-fed inkjet presses, which entered the market much later than web-fed presses, are on a strong growth trajectory despite overall market challenges. According to I.T. Strategies the compound average growth rate (CAGR) for B3 format sheetfed inkjet presses is projected at 24% between 2021 and 2026, with CAGR of B2 and B1 formats at 19% and 74% respectively.

A couple of points to put those statistics in context when comparing growth of different sheet-fed formats and sheet-fed to web-fed. First, sheet-fed presses are starting from a much lower number than web-fed sales so, despite higher growth rates, the installed base of sheet-fed presses will likely remain less than half that of web-fed presses through 2025. Second, since most web-fed presses are dramatically more productive than sheet-fed presses, the majority of page volume will continue to come from web presses for the foreseeable future. It’s also interesting to note that the earliest sheet-fed inkjet presses on the market were B2 format, first from Fujifilm and Screen and then from Delphax, Konica Minolta and Komori. As of 2019 the breakdown of sheet fed installations was roughly 60 percent B3 and 40 percent B2 and larger. By 2025, it’s expected that B3 will represent 70 percent of installations despite expectations of additional B2 presses reaching the market. In general, B3 presses are less expensive and therefore more attainable by a broader audience.

When looking at the pace of inkjet R&D, consider that many printer OEMs also have a significant office division e.g. Canon, HP, Ricoh and Xerox. The work-from-home impact of the pandemic decimated office inkjet revenues. Smythe notes that, in some cases, this was partially offset by record volumes in home/home office printing. While these are typically separate divisions, the overall corporate revenue picture has a trickle-down effect on divisional R&D and marketing budgets. This, along with a dearth of shows available for launching new products may have dampened the enthusiasm for launching new presses in the past year. So far, the only actual “launched and available” presses in the past year have been the Canon ColorStream 8000 in May 2021 and the Super Web Digital WEBJet 2100P Printing System announced in January 2022. Both of these presses target convergent aspects of the transaction printing and direct mail segments, as well as portions of the publishing and commercial print markets that don’t require offset coated papers.

Canon ColorStream 8000

The ColorStream family of inkjet presses is one of the most successful press lines on the market with more than 1,500 worldwide installations prior to the launch of the 8000 series. The new generation has built on this success with more speed, more channels, higher resolution and a wider range of compatible substrates. There are two models available and key features include:

- Speed of 133 m (436 ft)/min for the 8133 model and 160 m (525 ft)/min for the 8160 model with a 22 inch/560 mm web width and 21.25 inch/540 mm maximum print width.

- Kyocera 64 kHz drop-on-demand piezo heads delivering 1,200 x 720 dpi resolution on the 8133 and 1,200 x 600 dpi on the 8160.

- 6 color stations with the 5th and 6th available for MICR, security or custom inks. (No plans for expanded gamut at this time.)

- Supports uncoated and inkjet formulated paper weights from 40 to 160 gsm.

Super Web Digital WEBJet 2100P Printing System

The WEBJet 2100P was actually installed and on the market for nearly a year before the launch announcement. Super Web made many upgrades to the WEBJet series with the 2100P including moving from Memjet VersaPass dye to Memjet Duralink pigment printheads which have slightly higher resolution with a broader color gamut and longer life. The press is also configured with a scalable Adphos web and air knife drying units. Key features include:

- Speed up to 149 m (490ft)/min with a 20.5 inch (520 mm) web width and 17.5 inch (445 mm) maximum print width.

- Memjet MEMS thermal aqueous drop-on-demand piezo heads offer 1,600 x1,585 dpi resolution

- Supported paper weights listed as 16 lb. bond to 7 pt. (approximately 60 to146 gsm). Compatibility with uncoated and inkjet formulated grades.

- Easy configuration with proprietary Super Web finishing for an “all in one” platform including slit & merge, perforating, punching, cutting, folding, and/or stacking solutions.

(More data on both presses is available on the InkjetInsight.com Device Finder.)

What’s Next?

While only two new presses made it fully to market, one more is coming soon. Kodak announced the Prosper Ultra 520 in June of 2020 and will be showing the press running at their “Innovation in Action open house” on June 15 and 16 in Dayton Ohio with sales beginning later this year. Also, Ricoh teased the Z75 B2 sheetfed press in December 2020 and again in May 2021, but we can’t confirm that it will come to market in 2022.

Meanwhile a host of finishing and efficiency suppliers are offering solutions to help printing companies handle scarce paper and labor resources more efficiently while increasing the value of printed pages. Smyth notes that there are innovative solutions on the market, particularly for roll fed environments, from Contiweb, Hunkeler, Horizon, Muller Martini, and Tecnau and others that deliver “roll-to-product” solutions. “Clever print companies can re-engineer print manufacturing with inkjet – digitizing integrated production to move away from the traditional serial print manufacture with lots of deadtime and WIP on the floor,” he notes. “I also think there has been a change in print company outlook, looking at appropriate technology for a particular task with intelligent workflows following rules to manufacture print products efficiently.”

In the end, inkjet is coming full circle with the notion of reengineering production at the heart of continued inkjet adoption and success. In addition to looking for continued enhancements to inkjet platforms such as inline quality control, simplified operator environments, streamlined maintenance processes and of course print quality, printing companies should be looking closely at opportunities to surround these systems with automated manufacturing hardware and software solutions. This is where opportunities can be found to drive down total cost of ownership, drive up profit and deliver more value with every printed piece.