Most inkjet printer manufacturers are either private (Durst) or part of a larger public company for which inkjet is only an element of their portfolio (HP, Canon, Ricoh, etc), so it is hard to gain insight into the performance of the inkjet business. Publicly-traded EFI is a big dog in the inkjet park, and inkjet accounts for about 60% of its sales, so it provides more insight into the hardware and consumables business than its competitors. It recently acquired a new CEO from outside the industry, and yesterday it held an earnings call with analysts to discuss its Q3 results. (I should say that that what follows is not intended to be an in-depth analysis of EFI’s business, and is certainly not investment advice.)

First, a quick overview: for the first time, EFI is on track to break one billion dollars in sales for the year, after teetering just below that magic number for the last couple of years. In the most recent quarter, inkjet accounted for $155m in sales, for a total of $454m out of $758m in the 9 months YTD. Since the Jetrion label-printing equipment business was off-loaded to Xeikon last year, this inkjet revenue is mostly made up of ink sales, wide-format graphics printers (Vutek & Matan), Cretaprint ceramics printers, and Reggiani textile printers. The non-inkjet businesses are the Productivity Software division, contributing $40m to Q3 revenue, and the Fiery DFE adding $61m. The last two – being mainly software – have gross margins around 70%, whereas the inkjet group averages only 34%.

The good news for EFI shareholders is that Q3 revenues reached a new record; the bad news is that the share price has not recovered from the 50% fall it took in July 2017, and the company is barely breaking even. Revenue recognition and stock valuation issues were a drag on performance last year, and the cash-cow Fiery DFE business is in secular decline, down 11% for the 9 months YTD compared to 2017. The company’s challenge is to replace this high-margin revenue stream as it declines and to find new opportunities for its software, firmware and inkjet competences. Fortunately, productivity software is selling well – up over 13% for the 9 months – and so is ink, which too enjoys good margins, although supply problems have held back sales in the most recent quarter.

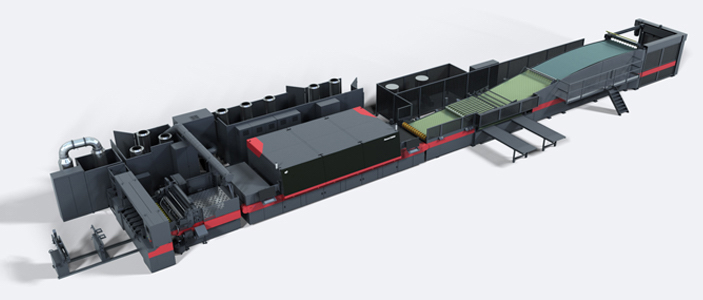

But what was most striking about the latest analyst call was the emphasis placed on Nozomi. The Nozomi C18000 is EFI’s single-pass UV inkjet printer targeted at the $9 billion corrugated board market. Using Seiko print heads and capable of printing 1.8m x 3m boards at up to 75m/minute (246fpm), this 30m long behemoth was announced at the last Drupa, and now has several high-profile installations in North America and Europe.

It competes with new machines from HP, Barberan, Sun Automation, Durst and others. We learned this week that EFI shipped seven Nozomi machines in Q3 and expects to ship eight more in Q4; and that the company has enough single-shift production capacity to make 10 machines per quarter. EFI expects 2018 revenues from Nozomi to be $70m, and for this to increase to $120m next year.

It competes with new machines from HP, Barberan, Sun Automation, Durst and others. We learned this week that EFI shipped seven Nozomi machines in Q3 and expects to ship eight more in Q4; and that the company has enough single-shift production capacity to make 10 machines per quarter. EFI expects 2018 revenues from Nozomi to be $70m, and for this to increase to $120m next year.

This is significant for several reasons:

- EFI claims that, within a year of installation, each Nozomi will consume between $500,000 and $1,000,000-worth of ink – significantly more than a scanning printer, and likely at much better margins than the ceramics ink used by the Cretaprint machines.

- EFI seeks to pull through sales of its ‘Corrugated Packaging Suite’ of software to Nozomi purchasers, providing a high-margin software sale with an annual maintenance revenue stream, as well as the ink annuity.

- EFI plans to announce a textile version of Nozomi called ‘BOLT’ in Italy before the end of this year. The expected volumes are lower than for the corrugated machine, but these will also drive ink sales (Albeit aqueous, and not UV-curable ink.)

- As EFI ‘rides the experience curve’ to greater volumes, manufacturing costs should come down, yielding higher margins.

- It can be expected that, as EFI gains experience in making wide-format, single pass printers, this technology will be applied in the display graphics segment too.

EFI’s new CEO Bill Muir comes to the company from Jabil, a global product design & manufacturing company with a much larger footprint than EFI – 100 sites, 177,000 employees, and $22 billion in sales. Given his strong international manufacturing background, and the stock incentives the EFI board has given him, it is likely that he will not only continue EFI’s policy of acquiring inkjet-related manufacturers that provide access to new digital printing opportunities, but he will also seek to do a better job of integrating these disparate entities, and taking cost out of their manufacturing processes. This week’s Nozomi announcements are surely only the first step in some substantial changes at EFI.

Chris Lynn of Hillam Technology Partners provides product strategy & business development consulting for technology companies with a focus on digital print and packaging.