By Marco Boer, Vice President I.T. Strategies

Commercial Printers Facing Unexpected Pressure to Adopt Production Inkjet

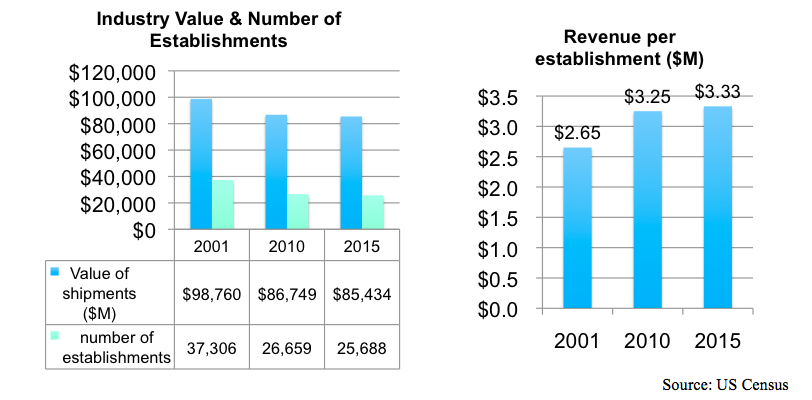

The world of commercial print is not an easy one. According to the US Department of Commerce, commercial print output revenues are down 8% from 2016/2017 in N. America, the steepest decline since the 2008/2009 economic recession. Paper and offset ink suppliers have announced multiple consecutive price increases during the last twelve months as declining economies of scale work against their raw material purchases and mill closures reduce available supply. This in turn continues to drive the reduction in the number of commercial print establishments. But yet, many of the remaining commercial printers are feeling pretty good. The reason for this is that fewer commercial printers are sharing a still very large amount of revenue, driving up the average revenue per establishment from $2.65 million in 2001 to over $3.3 million in 2015.

Figure 1 Fewer Printing Establishments Lead to Higher Revenue Per Establishment

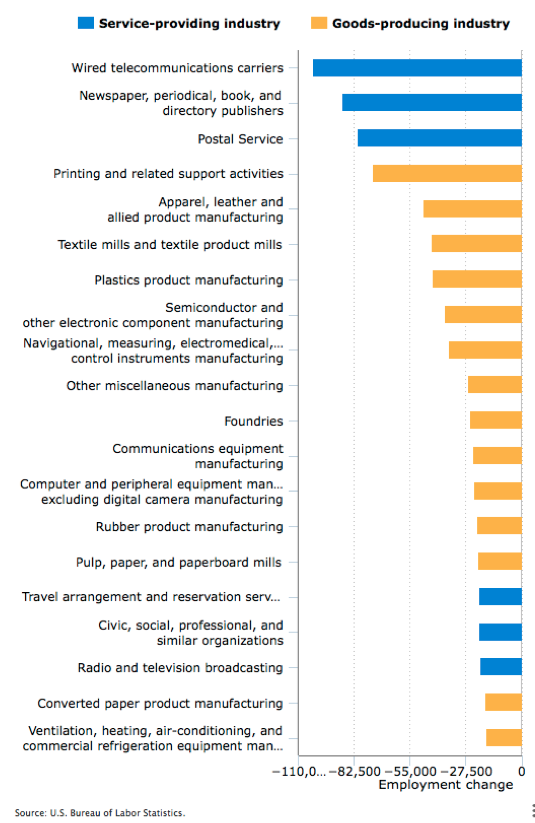

There is a new challenge however, one that seems to be looming faster than most had anticipated: a lack of qualified labor to run printing plants. With the US economy at full employment, labor is a challenge for most businesses. It is an even bigger challenge for the printing industry. According to the US Bureau of Labor Statistics, the printing and related support activities industry will have the fourth steepest decline in available labor of any industry, trailing the labor decline in the postal service, publishing, and wired telecommunication. One can have the most beautiful offset presses with large capacities in the world, but if there is no labor, they will sit idle.

Figure 2 Career Outlook by U.S. Bureau of Labor Statistics, 2017

The long-term trend towards smaller run lengths has been putting pressure upon commercial printers for years, but with fully amortized offset presses they’ve been able to manage by using more labor as their pre-press workload increased with smaller, more frequent runs. But with a strong US economy, the lack of qualified labor is adding unexpected further pressure upon commercial printers to automate, to become more efficient.

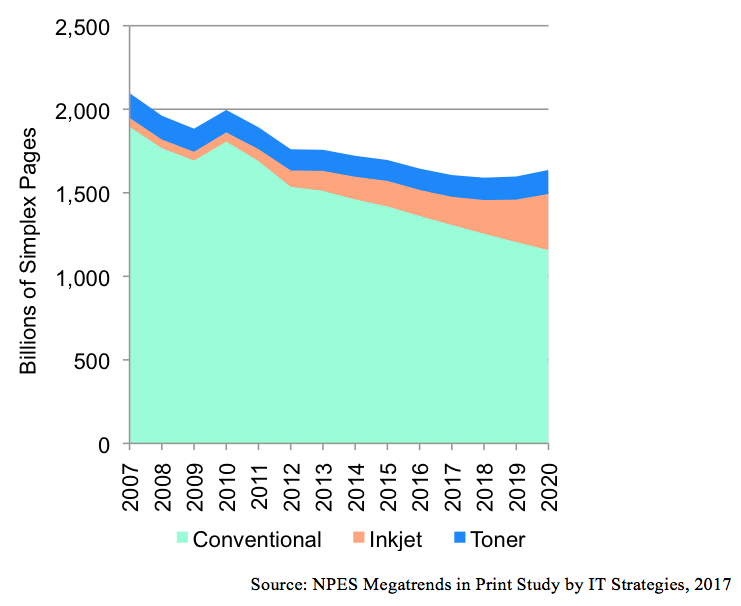

There are very, very few young people entering the printing business to replace aging and retiring offset operators. Constraints on immigration are further adding to the challenge in what is effectively a manufacturing industry. The print industry has no choice but to run printing systems with fewer operators. This means it has to become more digital, as unlike offset presses that take multiple operators per press to run, a single operator can operate multiple digital printers. Digital color toner presses have taken up the slack for the high-value, often variable data short-runs, but after 20 years of existence their limited throughput capabilities and high running costs have enabled them to address only a little more than 8% of all commercial pages printed.

Figure 3 Document Page Volume Trends by Technology, North America. Billions of Equivalent Simplex Pages

Production inkjet technology is 3-10 times more productive than digital color toner presses, which has enabled inkjet technology to capture over 10% of all commercial pages printed in less than 10 years of existence. Production inkjet printing technology has not yet been able to match the range of substrates offset and toner presses can print on, which has limited production inkjet mainly to transaction, direct mail, and mostly monochrome book printing applications.

There are two factors that IT Strategies believes will change the acceptance of production inkjet technology for more mainstream document applications like marketing collateral. The first change is a realization by commercial printers that no customer is going to pay him more for featuring better print quality or better service than his peers. The legacy business model of have the highest quality at the lowest price is not sustainable, it only results in less revenue and lower margins. The commercial printers that are making money are doing so by adding value to print through data, analysis, and even variable data printing. By offering their customers insights on how print motivates their customers to respond, they are becoming part of the broader solution. It changes the topic of conversation from cost to the ways that they can help the customer to drive their business. This change is not easy, because it requires deep insight, trust, and investment in resources that have little to do with the actual printing process. It also opens the door to conversations about what level of print quality is acceptable. Production inkjet may not yet match offset output quality, but it can be quickly established if it is sellable or not sellable. If the value in the output shifts to a conversation about the quality of the print to the value of the content, the commercial printer will have secured his future.

Figure 4 New Business Models Focusing on Cost and Quality Trade-Off

The second factor is improvements in ink technology and pre-coat fluids. The inkjet manufacturers are still in the early phases of trying to find viable solutions – technically and economically – that will allow production inkjet printers to print on standard, low-cost offset stocks. Progress is being made, and the good news is that most of the offerings being introduced are backwards upgradeable for existing inkjet press owners. IT Strategies expects that the next two years will bring significant breakthroughs in this area, enabling production inkjet printers to capture up to 20% of all commercial printed pages.

Regardless of the pace of the breakthroughs, the fundamental overarching problem of a lack of qualified labor is what will drive more commercial printers to inkjet technology. It is going to change commercial printers business models, however uncomfortable that may be. But as Eric Shinseki, US Army General, head of supply management during the Gulf War has succinctly noted: “If you don’t like change, you’re going to hate irrelevance”.

The good news for the remaining commercial printers is that for those that have the vision and the means, investing in automation will become a little easier in 2018 with changes in the US tax laws allowing full depreciation of capital investments during the year of purchase. IT Strategies expects this to put further pressure – from peers this time – to invest in production inkjet technology. The commercial print industry has turned the corner: data driven personalization and programmatic marketing campaigns across all print applications are becoming a requirement, not a luxury. Production inkjet is a core part of this requirement, and its growth as a technology is critical to the long-term prosperity of the commercial print industry.

Editor’s Note:

Marco Boer, Vice President, I.T. Strategies is a trusted consultant to the digital printing industry and has developed a deep understanding of inkjet printing technology and its applications through years of market research and consultation with OEMs. I have had the pleasure of serving with him for several years on the advisory board for the annual Inkjet Summit where he has demonstrated a keen ability to put complex information and concepts into a context that is easily understood by his audience. We deeply appreciate his contributions to Inkjet Insight.

Marco Boer, Vice President, I.T. Strategies is a trusted consultant to the digital printing industry and has developed a deep understanding of inkjet printing technology and its applications through years of market research and consultation with OEMs. I have had the pleasure of serving with him for several years on the advisory board for the annual Inkjet Summit where he has demonstrated a keen ability to put complex information and concepts into a context that is easily understood by his audience. We deeply appreciate his contributions to Inkjet Insight.

If you enjoyed this post from Marco, you may also enjoy his video interviews on:

… and please consider registering to receive the Inkjet Insight newsletter with “colorful drops of inkjet knowledge” delivered to your inbox.