It was frequently suggested that Chinese exhibitors outnumbered any other country, even Germany, at drupa 2024. However, there has been little coverage on what those Chinese companies exhibited. In this article, we will give it a try for high-speed inkjet products. Although, with more than 400 registered Chinese exhibitors, even this approach be patchy.

It is challenging to get detailed information from Chinese vendors as a journalist or analyst – and this is not just down to language issues. Often there is a lack of awareness among these OEMs of marketing and PR expectations as well. In all fairness, the tight time schedules of journalists at drupa did not leave a lot of time either. Inkjet Insight contributor Oleg Litvinov did a great wrap-up of Chinese manufacturers at the end of 2022 but the market is still in flux.

Below is information on 11 vendors that invested in sizeable booths and mostly with equipment present. It is possible there were more companies that I missed and if you know of one, please get in touch. Most covered here had document printers but label and packaging printers were on display as well. A show report from All In Print China from November 2023 listed nine vendors with high speed colour roll-fed document printers on offer, all featuring a 1,200 dpi max resolution. Not all those listed were at drupa, with the probably best known, Founder Electronics, not exhibiting at drupa this time even though they did in 2016). Here is the list alphabetically with pictures where available.

Arojet

With the full name of Guangdong Arojet Inkjet Technology Co., the company offers two models under the “440 Colourful Digital Rotary printing machine” name: the E-C and the E-D models. The E-D has a separate unwind, while for the E-C it is integrated. Both have a duplex printing unit within one cabinet. Mono, spot and process colour versions are available, either with Epson or Kyocera inkjet heads. Resolution up to 1,200 x 1,200 is achievable. The latter can reach up to 150 m/min (492 fpm) speed. The max web width is 480 mm, while the max print width is only 432 mm.

Atexco

Atexco is a brand of Hangzhou Honghua Digital Technology. The company showed the VegaPress 440/660HD at drupa in the prestigious hall 8, where most digital presses were located. The press prints up to 1,200 x 1,200 dpi and reaches 150 m/min (492 fpm) at 600 x 1,200 dpi. Max web width can be 432 or 648 mm. Mono or process colour versions are available with water-based pigment inks. Installations in India and Russia exist already.

Not shown but available is an industrial print version with 600 dpi and a reduced speed of 75 m/min. Atexco also offers textile printers and inks. A note on the press below stated that the device has been sold to a printing company in Turkey

Atexco VegaPress 440, roll-fed document colour document printer

Flora

Flora is a well-known brand in China for inkjet printing from Shenzhen Runtianzhi Digital Equipment Co,. LTD. The company also started to supply Ricoh with wide-format printers. The company offers additional solutions in document, label, wide format and packaging print.

At the drupa booth, the Phenix 440C was launched and showcased. It is the latest model in a series of versions of the roll-fed document press. The 440C achieves up to 100 m/min at 600 x 1,200 dpi, with 1,200 x 1,200 possible at lower speeds. The max print width is 436 mm with water-based pigment inks in process colour. The press is ultra-compact and offers a sheeter. Other versions offer simplex only, monochrome print or widths from 332 to 660 mm. Flora also exhibited a label and multi-pass corrugated and wide-format décor printers.

Flora Phenix 440C – process colour roll-fed document printer

General Inkjet Printing (GP)

GP showcased the latest label printers at their booth, which prominently feature an AGFA workflow. The company presented several inkjet label printers like the new entry-level Label Smart 330S, which is about to launch. The LabelSmart comes in three print widths up to 324 mm and uses four colours plus optional white. LED UV inks are used and the speed tops at 50 m/min at 600 x 600dpi.

GP Label printer

GP also showed the HARPY-Series document printers at their booth. The printers have already been launched and are shipping. The HARPY R440 models are available in monochrome and colour with speeds up to 100 m/min and the HD-versions achieve a resolution of up to 1,200 x 1,200 dpi. Max print width is 432 mm. The top-of-the-line model R520C HD offers a print width of up to 535 mm and a speed of 150 m/min. The printers have a two-tower design and are somewhat longer than most other presses discussed here. The HARPY document printers also feature an AGFA Apogee workflow.

GMB

GMB stands for Wenzhou Guangming Printing Machinery Co., Ltd., a company focussed on laminating machines so far. In a move to diversify, the company showed the iJet 2500S corrugated printer at drupa. There are several versions available, single-pass and multi-pass. The multi-pass version uses Epson heads, water-based dye or pigment inks and offers up to 720 x 600 dpi resolution. The width is only 512 mm, although wider version should be available on request. The print speed can be up to 1.6 m/second (315 fpm), depending on the feeding type and automation.

GMB iJet 2500S – single/multi-pass inkjet printer for corrugated

Hanway/Hanglobal

The Hanglory Group has several subsidiaries, including HanGlobal (labels, books and publishing printing), Hanway (corrugated printing), HanSharp, HanTop (flatbed and roll UV printing), CNTOP and HOMER (garment & textile printing), and an ink subsidiary. Not surprisingly the company had a sizeable booth in hall 8 – the digital print hub.

Hanglobal is the division offering document and label printers and showcased the Kirin660X at the booth. The presses have been available for some time and there are installations, outside China, in Poland, France and Russia for example. The are several models in the Kirin line with 432, 540 and 648 mm web widths. The presses achieve a speed of 100 m/min and offer duplex print in one tower.

Hanglobal also showed their UV inkjet label printer at drupa.

Hanglobal Kirin660X – roll-fed colour document printer

The Hanway subsidy presented the Glory1600 HD – series at drupa. The presses have been available for a while and exist in four and six-colour versions, with installations in the US, Italy and Russia for example. More details are in the Post-Press corrugated buyers guide.

Hanway Glory1600 HD – single-pass corrugated printer

KingT

The KingT-Group is a well-established supplier in China, offering a range of inkjet presses for labels, corrugated, flatbed and document print. Most presses from KingT use Fujifilm Dimatix inkjet heads. The company was also the first one to announce a product using Fujifilm’s SkyFire head, which was launched at drupa. It is used in the KGT-2513-Hi UV-flatbed printer.

As the only supplier from China, KingT has a sheet-fed inkjet press in its portfolio, the H-Press 750S – using a B1 Format. Unfortunately, the press was not on display apart from a few live streaming sessions, hence I did not get any detailed information. The press reportedly uses Fujifilm Samba heads for a 1,200 x 1,200 resolution and prints 4,000 B1 sheets per hour. KingT also offers the L-Press 510, a roll-fed colour document printer with a max resolution of 1,200 dpi, which was not shown live as well.

KingT instead displayed the new label press, the L-Press 330S.

KingT L-Press 330S, inkjet label press

Pulisi

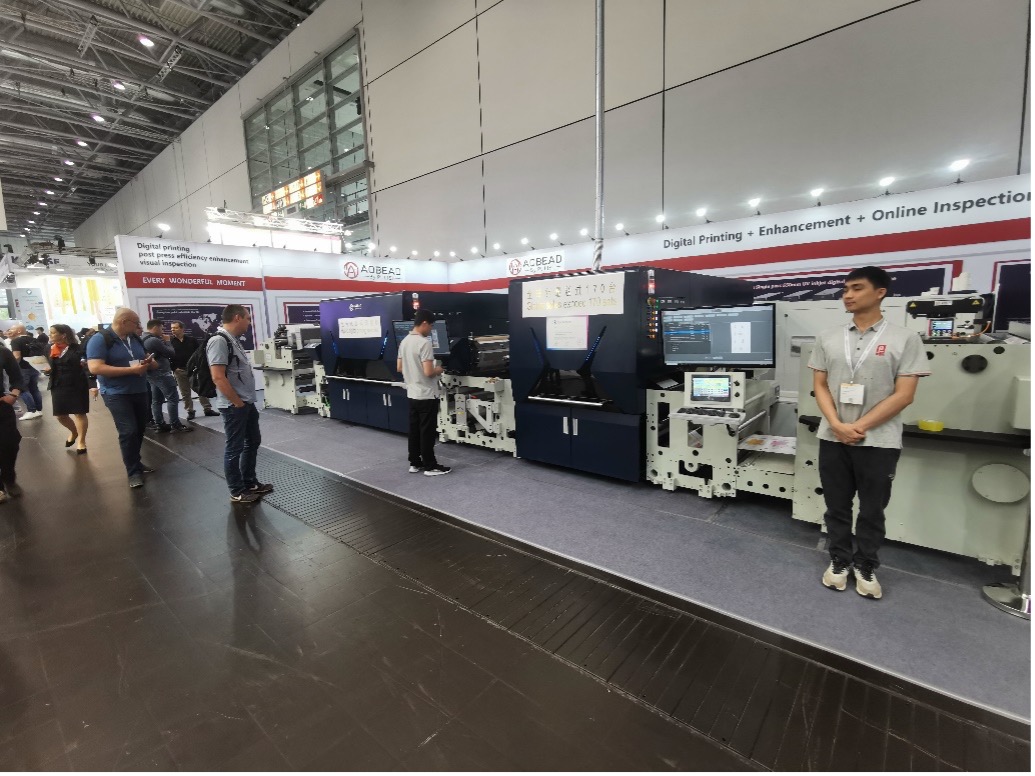

Pulisi, with the full name of Guangzhou Pulisi Technology Co, showed the Aobead DPIM-550 inkjet printer at drupa. Unlike the other vendors, Pulisi offers a hybrid solution using UV inkjet. Resolution can run up to 600 x 1,200 dpi and speeds up to 60 m/min. The printer offers white and a spot colour in addition to CMYK. Various embellishment units can be embedded. A maximum width of 550 mm makes it suitable for labels and other applications. A narrower web, inkjet only press is available as well.

Pulisi Aobead DPIM-550 hybrid UV printer

Shield

Shield has been offering inkjet document printers for years and already had a web-fed printer at All In Print China in 2019. At drupa 2024 the M440C, a full colour web-fed document printer was exhibited, which was originally launched in 2020. Shield is using Memjet heads in their document printers, which achieves a resolution of up to 1,600 dpi accordingly. The maximum speed is 120 m/min. There are several models in the range with different widths.

Shield M440C inkjet colour press

Wonder

Shenzen Wonder Technology brought the WD200+ single-pass corrugated press to drupa 2024. Versions of the printer can have a 600 or 1,200 resolution across the feeding width. In print direction, this drops to 200 dpi for 1.8 M7sec or 150 dpi for 2.5 m/sec linear speed. The max width is 2500 mm (8.2 feet) and substrate thickness can range from 1.2 to 20 mm. The printer uses water-based process colours. A UV version is available as well. A varnishing unit is optional.

Wonder also offers a large-scale industrial printer with the INNO 108Pro, reaching a resolution of up to 1,800 dpi.

Wonder WD200 Single Pass corrugated inkjet printer

Yintech

Yintech exhibited the roll-fed DOM440C process colour document printer at drupa. The specs seem familiar with 150 m/min speed, a max print width of 432 mm, and a resolution of up to 1,200 x 1,200 dpi. The printer was announced in 2023 originally. There should be other versions in wider widths available as well. A source states that standard coated paper should be usable, although this was not included in the specs at drupa. A possibility is that a separate drying tower might be needed. As exhibited, the printer is very compact. Yintech also displayed a roll-to-roll label printer.

Yintech DPM440C, process colour roll-fed document printer

Chinese inkjet presses today

China is a big market for inkjet presses. At the same time, the specific size is not known. Even well-established analyst firms shy away from publishing Chinese installation numbers as they are hard to verify. There is no doubt, however, that considerable demand sparks substantial manufacturing activity in China. I was able to attend All In Print China in 2019 and even back then the line-up of inkjet presses was impressive.

Unlike in other technology sectors, the Chinese inkjet press supply has not spread into other geographies significantly yet. There have been occasional installations in Europe and a (small) number in Russia as covered in the Inkjet Insight Installation Roundup reports. The latter is primarily the result of US, European, Korean and Japanese vendors withdrawing after the Russian attack on Ukraine and Chinese manufacturers seizing the opportunity.

There are more than 10 manufacturers of colour roll-fed inkjet presses in China. The number of label press manufacturers should even be bigger but drupa is not a label show. There is less activity in sheet-fed inkjet for document and packaging print, although in corrugated the activities picked up noticeably.

Inkjet technology has an advantage: it offers quick access to a market, as high-quality print heads can be brought in from several vendors. Moreover, the development speed in China is very quick, as demonstrated by the first product using Fujifilm’s brand-new SkyFire heads originating from China.

Striking are the many different options or variants typically offered. Speed, number of colours, width, automation, feeding – all can be adapted, added or excluded, down to barebone devices. I assume that offering lower automation, and lower cost versions is a necessity to get a foothold in the Chinese market. Also, print quality is somewhat negotiable. Remarkable is also the small footprint most presses have. This points to another necessity for domestic customers: limited space on the production floor. Clearly, Chinese presses have been developed for the Chinese market. Now they need to prove their fit in other geographies.

Would you buy a Chinese press?

PrintWeek in the UK recently asked their readers: “Would you consider buying kit manufactured in China?” Nearly half of the 200 respondents (47%) answered either ‘Yes’ or ‘Possibly’ – although this would include all kinds of graphic arts machinery, from analogue presses to finishing machinery. In digital print, the reality proves that there is little activity so far, although that could increase.

Obviously, the most important information is missing in the listing above, that is the price of equipment and inks. Both are negotiable of course and need to be explored in discussion with the vendor. Chinese products are known to come in at a very competitive price. Also ink prices should be low. An example is Chinese inkjet inks being pushed towards existing inkjet press users occasionally and these are often quoted to be noticeably cheaper than inks sold by the OEM. They can be less than half the price of the original ink.

The main question is, are the cost savings worth the potential issues? The specs of the devices sound quite competitive in general – at least the ones assembled on a spec sheet.

The web widths specified are often somewhat beyond the mainstream, being either smaller or wider than the 2-up presses from the leading vendors. The substrate capabilities tend to be a bit cryptic, often it is unclear what types of paper can be run. If not specifically mentioned above, the presses should not be able to print on standard coated paper. On occasion, unusual substrates like rice paper or wallpaper are supported instead.

An area beyond a quick assessment is DRF/RIP, workflow and ancillary software (like batching, colour management, etc.). Chinese-made presses use the vendor’s own DFE with the presses. Usually, PDF and TIFF formats are supported but there is a lot more needed to keep a press running. Especially colour management is critical and samples displayed by the vendors often underscore this need. Impossible to say how easy to use the DFEs are, and how time-consuming troubleshooting and maintenance are.

Difficult to judge is also the quality. The specs promise high quality, although samples tend to look disappointing. RIP and colour management (see above) play a role but also the quality of the inks, drying, primer (no Chinese press seems to offer one), web control and many other factors. Inline QC is hardly ever mentioned with the presses. Established inkjet press manufacturers spent years honing and fine-tuning inks and primers, which is paying off in quality and reliability. Also, a noticeably lower price in inks might fire back in terms of quality, reliability and shelf-life.

There might be other factors to watch out for: are presses and inks compliant with your regional health & safety regulations? Is all documentation and DFE (including submenus) available in your language? How will Chinese IT Technology and cloud-solutions for online tools fit into your plant?

If you are interested, a main obstacle can be getting hold of a press. The vendors tend not to have own subsidies abroad and rely on national dealers, although the networks are patchy. In fact, all vendors I spoke to are in search of additional dealers in diverse countries. A lot of the useability of a production press depends on the service and availability of spares and supplies. The longer the supply chains, the more can go wrong. A trustworthy dealership can go a long way here if it is willing to set up the necessary service and supplies infrastructure. Still, some elements needed to keep a press running productively might be beyond the control of a local dealer.

Nevertheless, inkjet technology from China is progressing rapidly and we are going to see more in the future. For more basic uses, like monochrome roll-to-roll, the presses can already be a good match for printers outside of China. Possibly future printers will be designed with more of an international market in mind. The higher the requirements for an inkjet press are (productivity, quality, substrate range, uptime), the more pitfalls will arise, however.

If you have a Chinese-manufactured printer in operation, I would like to know your feedback. Please get back to me at ralf@digitalprintexpert.de